Nothing new really. He's been rehashing the same old tired lies as new material for a "shocking" expose of what PAP is doing to Singapore.

On 19 Nov 2015, Chee SJ warns us in a FB post of the "serious" situation that Singapore is in due to its private debt levels. While referring to a previous SDP article, he quotes a single graph from the Economist and says:

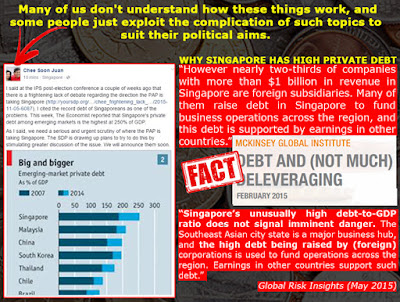

"I cited the record debt of Singaporeans as one of the problems. This week, The Economist reported that Singapore's private debt among the emerging markets is the highest at 250% of GDP. As I said, we need a serious and urgent scrutiny of where PAP is taking Singapore...."

Chee's post is, at best, misleading and intended to give his readers and supporters an impression that there are aspects about Singapore and its governance that is wanting.

At worst, Chee is lying through his teeth again and attempting to selectively quote out of context to support his lies.

So is Singapore really in trouble over its private debt? Is there any basis to support Chee's claim?

Let's see what else the Economist article says.

"Growing debt in emerging markets is not of itself something to worry about. It may be that savings are getting into local capital markets more effectively or that there are more, better investment opportunities...."

"...The most highly indebted emerging markets, such as China, South Korea, Singapore and perhaps Thailand, mostly fall into Mr Pradhan’s second category. They are unlikely to suffer an abrupt crash brought on by capital flight; most of them have formidable defences against a balance-of-payments crisis..."

What do others say about Singapore's high private debt levels?

"... Singapore’s real economic debt has increased by a staggering 162 percentage points, amounting to a debt-to-GDP ratio of 382 percent—almost as high as Japan’s 400 percent, topping the list. However, Singapore’s unusually high debt-to-GDP ratio does not signal imminent danger.

The Southeast Asian city state is a major business hub, and the high debt being raised by (foreign) corporations is used to fund operations across the region. Earnings in other countries support such debt...."

Global Risk Insights, 2 May 2015

"... For some nations, an unusually high debt-to-GDP ratio does not signal imminent danger. These are places that serve as business and financial hubs. The high level of financial-sector and corporate debt that results may or may not involve heightened risks.

Singapore and Ireland, for example, have tax regimes and other regulations that make them attractive for locating operations of global corporations. The debt incurred by these entities is used to fund activities in other nations, so its relationship to the host country’s GDP is not indicative of risk.

As a major business hub, Singapore has the highest ratio of non‑financial corporate debt in the world, at 201 percent of GDP in 2014, almost twice the level of 2007. However nearly two-thirds of companies with more than $1 billion in revenue in Singapore are foreign subsidiaries. Many of them raise debt in Singapore to fund business operations across the region, and this debt is supported by earnings in other countries.

Singapore has very high financial-sector debt as well (246 percent of GDP), reflecting the presence of many foreign banks and other financial institutions that have set up regional headquarters there...."

McKinsey Global Institute, Feb 2015

So is this really a dark, scandalous secret that the Singapore PAP Government is hiding from her citizens?

Is Chee really pulling back the curtains on a corrupt government, or is Chee actually pulling the wool over his readers and supporter's eyes?

Contrast what these various publications are saying against what Chee is claiming. Do you still think Chee is telling the truth or simply trying to lie and deceive you?

Look at it another way - International bankers and investors are not stupid and gullible. They will do their own homework and will seek out safe markets where their cash and investments can be safe and make them money. Do you really think that these investors would not be astute enough to see pass any govt propaganda that attempts to window-dress the situation and assess the the actual state of the economy for themselves?

And how about the fact that so many publications give a similar explanation for the high private debt. Do you really think that these international publications would gamble with their reputations and put up a poorly researched article? Would these publications stand to gain by simply publishing "propaganda" from the Singapore government, or actually lose more by doing so?

Or it is more likely that Chee has more to gain politically from propagating his lies to Singaporeans?

As Chee sufficiently put it himself. Reputation is temporary. Character is permanent.

Chee has been, and always will be a liar.

But guess what, you don't have to believe me. Just do your own research and decide the facts for yourself.

Sources:

Global Risk Insights:

http://

Mckinsey Global Institute

http://www.mckinsey.com/

The Economist

http://www.economist.com/

Singapore Government Borrowings - An Overview, Jul 2011

http://app.mof.gov.sg/Portals/0/Feature%20Articles/Feature%20Article%20Singapore%20Public%20Debt%20Report.pdf

SG Government FAQ - Is it fiscally sustainable for Singapore to have such a high level of debt?

http://www.gov.sg/factually/content/is-it-fiscally-sustainable-for-singapore-to-have-such-a-high-level-of-debt#sthash.oYlyvVCJ.dpuf

No comments:

Post a Comment